Overview

In general there are two ways to finance infrastructure projects:

- Government Debt Issue: In this model the government simply borrows the money to buy the system and pays it back out of tax revenue. At the moment borrowing costs are at a historical low of around 3.6 per cent. However, the debt appears on the government balance sheet.

- Public Private Partnerships: This involves the government paying the private sector to finance the cost and has the benefit that the debt does not appear on the government balance sheet and the private sector assumes some of the risks. This is the preferred model for all Australian governments although it is somewhat more expensive.

Either method can be used to build monorail systems at the preference of the client government.

Monorails systems are well suited to PPP projects due to their low risk and potential for incremental delivery.

Conversely the low risk of monorails also lowers the risk to the government of building the system through direct debt issue perhaps making PPP less useful in the monorail context.

Rate levy funding

A small rate levy of a few dollars a week can be used to pay off borrowing for a monorail system.

Use the calculator below to determine the cost per week for each benefitting household.

This script provided by JavaScript Kit

Australia is a low public-debt country

|

Australia's tax-to-GDP ratio by level of government. ABS Catalogue 5506.0, Taxation Revenue, Australia; and OECD Revenue Statistics, 2012. www.Treasury.gov.au) |

Note the substantial difference between the OECD average taxation rate and the Australian net tax rate.

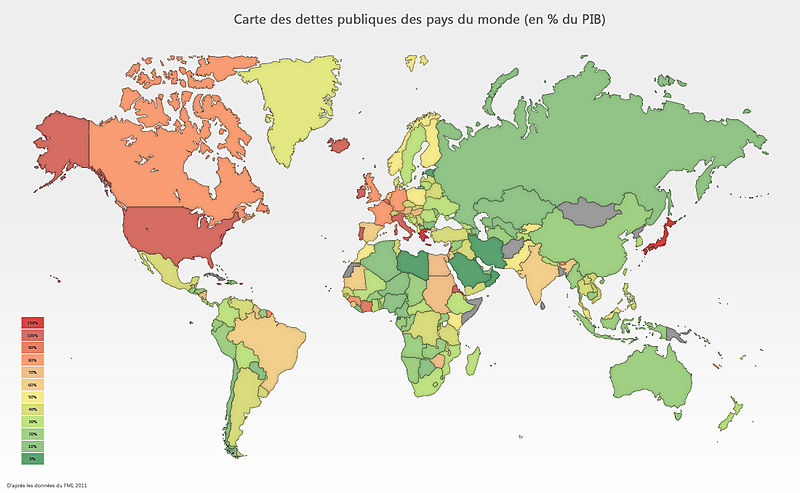

World public debt as a percent of GDP, 2011. |

Minimising overall risk and cost

We propose the following methods to keep both risk and cost down:

- Incremental Delivery: Most of the suggested projects can be broken down into small independently useful segments which can be built sequentially. The completion of each segment provides a 'break point' where the overall project can be evaluated against changing economic and political conditions.

- Optimal Risk Allocation: The contract formula should assign risks reasonably under the control of the contractor to the contractor. Other risk factors such as weather, civil disturbance and CPI movements should be valid reasons why the end-date to project cost could change.

- The Chance to Re-Tender: At the conclusion of each segment the contracting government could choose a new provider for the remainder of the system if the contractor failed key performance benchmarks. Contact clauses will deal with this situation so earlier segments are made available at an appropriate price to the final tenderer or the government.

- Proven Technology: Straddle beam Monorails have been in use for many decades so the technology is unlikely to be a risk factor.

- Elevated Systems: For the most part these monorail systems are above ground which reduces the scope for unexpected problems that often occur with subway construction.

- Mass Production: Monorail guide-way and station components can be produced efficiently at Component Mass Production Facilities and transported to the work sites lowering costs, improving quality and reducing risks.

- Free Use of Public Easements: The monorail system should be able to use public land such as road median strips at no cost, provided all reconfiguration of overhead wiring and street lights is included in the cost. This should include the right and responsibility of the contractor to maintain a 'tree way' on existing road median strips beneath the monorail guide-way.

- Free Use of Private Easements: The owners of private land where stations are to be built are likely to provide the land free of charge and to contribute to the construction cost of stations that benefit their land holding. Examples are at Crown Casino, Spencer Street DFO and Chadstone and Highpoint shopping centres. If no such agreement can be made then the monorail could bypass the particular land holding. Note that monorails have a very low footprint at ground level.

- Acquisition of Private Commercial Land: If a situation arises where re-development of private

commercial land is obstructed by a small minority of commercial land owners the contracting government will be

expected to acquire the outstanding commercial property at a reasonable price to allow the project to proceed.

In the case of some proposals such as the Melbourne Airport Link the contracting government may need to acquire land from Melbourne Airport for the project to proceed at all.

- Technology Licensing: Currently there is no "open" standard for any monorail guide-way system. As part of the contract negotiations with monorail manufacturers we advise that the contracting government acquire the sufficient rights to the favoured technology to enable them to source future monorail vehicles and components from other sources if need be.